Operating models of private banks must evolve. Investor expectations continue to change, while simultaneously AI and digital services are advancing quickly. Is outsourcing an opportunity for private banks as the competition heats up?

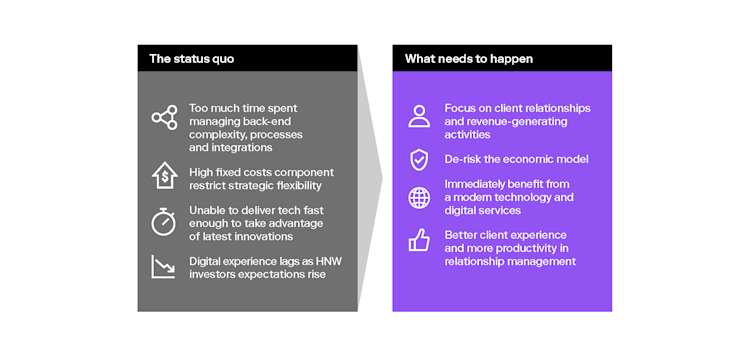

Private banks’ profitability is under threat – lack of tech leadership, agility and economic resilience are holding many back.

The private banking digital experience lags as HNW investors' expectations rise, impacted by retail competitors and AI interactions

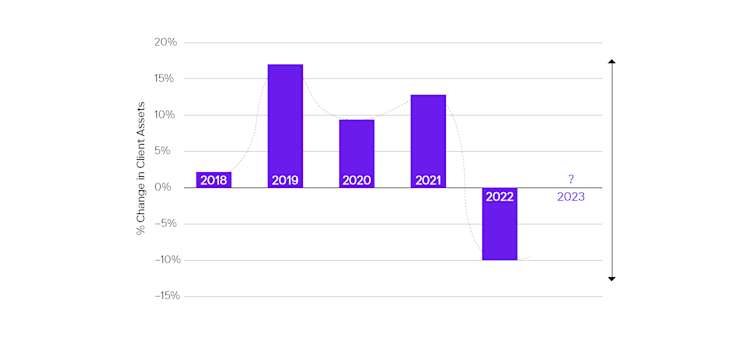

Revenues are derived from volatile assets, with end-client asset valuations varying 20% year-on-year, leaving little room to maneuver.

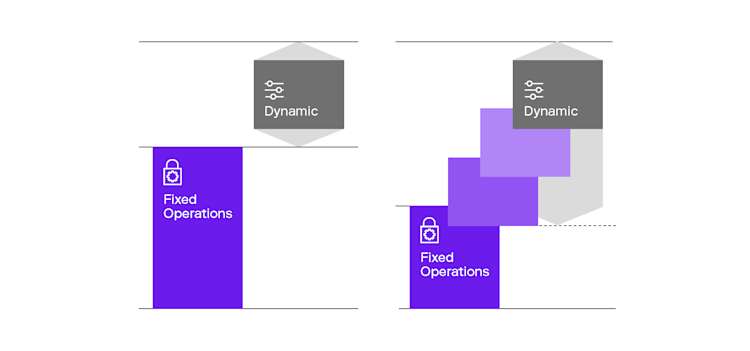

The sector relies heavily on fixed-cost operating models, seeing up to 75% of costs as fixed and inflexible.

New operational models are needed to enable private banks to take advantage of recent innovations, deliver on client expectations and stay resilient in volatile times.

Many private banks are considering adjustments to operating models. They are looking at the potential to outsource some or all of their non-differentiating activities and operational processes to:

Meet expectations for digital advice and relationship management.

Make the economics of onshore-offshore "hub and spoke" operating models work in practice.

Keep up with technology advances in data connectivity, AI and advice ecosystems.

Overriding this is the need for a more robust operational base that delivers on cost-efficiency and agility – and alleviates the pressure of excessively high cost-income ratios which often sit in the range of 75 – 85%.

Outsourcing is becoming increasingly popular among private banks. By transitioning from a high fixed-cost model to a more dynamic operational base, as showcased by FNZ’s end-to-end-platform, it is possible to boost agility and at the same time access up-to-date expertise, technology, and resources.

Patrick Laurent, Partner and Innovation Leader at Deloitte Luxembourg

Outsourcing private banking operations end-to-end: a realistic option

Outsourcing to an end-to-end platform provider, which combines infrastructure, technology and business processing operations into one efficient system is a credible way forward.

The end-to-end FNZ platform, described in our joint report, is a transformative approach that integrates technology and operations, including advanced APIs, data analytics, core banking, and digital solutions into one, all within a regulated financial institution. Banks are advised to consider such platforms as strategic partners for their future transformation.

Pascal Martino, Partner and Banking and Human Capital Leader at Deloitte Luxembourg

Deliver tech leadership for private banks in the era of AI

While opportunities exist, especially with AI, banks are suffering from too many complexities. What our wealth platform brings today is not only modern technology but also improving and de-risking the economic model. What we show with this report is that piecemeal outsourcing isn’t very effective, but full end-to-end platforms make sense for private banks who want to combine scale and agility in a much more resilient and regulated way.

Philippe Bongrand, Managing Director Private Banking

Related Case

https://fnz.com/news/bergos-goes-live-with-new-core-banking-system-on-fnz-platform