The democratization of wealth management is transforming the industry, offering both retail and mass affluent investors more options for growing their returns and managing risk. Personalized services and advice, once reserved for the wealthy, are now more accessible to all.

But firms must also prove their relevance to a tech-savvy and more demanding younger generation of investors raised on the immediacy and personalization of smartphone apps and digital-first services – that’s according to major global research from FNZ, ThoughtLab and Deloitte.

The study – titled Building a Future-Ready Investment Firm – which analyzed the views of 250 wealth management firms and 2,000 investors around the world, found that 60% of Gen Y and Z investors do not expect to use traditional advice services by 2030 due to advances in technology and the development of AI.

Advisors aren’t going anywhere. They will remain a bedrock of the industry, a source of human trust in an ever-changing environment. But, we expect firms to shift towards a ‘bionic’ model where AI-enabled tools will enhance productivity and efficiency.

However, it’s a stark warning: those in the sector will have to tailor their solutions to a more diverse base of younger investors or face being left behind.

Firms are already sharpening their focus on younger investors, who will become increasingly important as the transfer in wealth accelerates at pace. In fact, research firm Wealth-X predicts a $15 trillion wealth transfer from older to younger generations by 2030.

Gen Z is the first generation of investors raised in a digital-first environment, as Mark Smedley of Genesys highlights, they now have access to information that previous generations “could only have dreamt of”. As a result, they are “challenging the status quo” with an increased demand for smart and sophisticated digital apps, channels, tools and platforms.

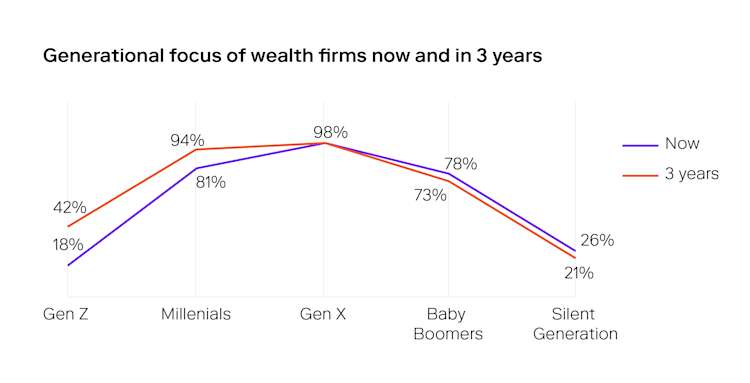

This graph shows how the focus of wealth firms is predicted to change in just three years to cater for this generational shift, with more expected to concentrate their efforts on a younger cohort of investors.

Source: Building a Future-Ready Investment Firm

Those that fail to modernize will lose out, our study shows. While 35% of investors would consider switching providers over the next three years, this figure rises to more than half (53%) when younger investors were asked the question.

There is also a significant shift in the adoption of different methods of decision making, with the percentage of young investors expected to use discretionary investment services doubling from 18% to 36%.

Digital innovation: the key to attracting young investors

So, how can firms make sure they stay ahead of the curve?

Younger investors have higher expectations for digital experiences and tools than their parents and grandparents. They are more interested in digital assets and are open to using automated tools: over the next three years, 52% of Gen Y and Z would like their primary investment providers to offer chatbots to answer queries, compared with 39% of Boomers and the Silent Generation.

Furthermore, 74% of younger investors expect digital experiences on par with leading digital-native companies, versus 61% of older generations, while 61% of younger investors want better digital tools to manage their investments directly.

On average, younger generations are also more willing to use AI for financial tasks:

Researching investment advice: 87% vs. 74%

Supporting investment advisors: 85% vs. 77%

Reviewing financial circumstances and aims: 79% vs. 70%

Younger investors are also more conscious than their older counterparts of mitigating the risks involved with tech developments. Nearly half (48%) of Gen Y and Z view data security and privacy as their biggest concern, compared to 42% of Boomers and the Silent Generation, while 43% (v 38%) worry about financial fraud.

Different goals for different generations

When it comes to investment goals, younger and older cohorts have distinct priorities. For the former, their focus is about investment growth to safeguard their future, while the latter are more concerned about ensuring their wealth benefits future generations.

Income generation: 70% (Gen Y & Z) vs. 40% (Boomers)

Tax optimization: 62% (Gen Y & Z) vs. 51% (Boomers)

Lifestyle preservation: 53% (Gen Y & Z) vs. 38% (Boomers)

Legacy planning: 10% (Gen Y & Z) vs. 40% (Boomers)

Philanthropic goals: 5% (Gen Y & Z) vs. 30% (Boomers)

A sector-wide digital transformation required

The wealth management industry still struggles with complexity and legacy technology holding back digital transformation. The adoption of modern technologies is happening at pace, but industry players will need to keep their foot on the accelerator to cater for the demands of younger generations of investors.

FNZ seeks to open up wealth by breaking down these barriers, helping to create a more transparent and personalized experience for customers. Our end-to-end global platform equips wealth professionals and advisers to deploy advanced digital capabilities and adapt to the evolving expectations of Gen Y and Z.

The industry is navigating a "perfect storm" of challenges, as a substantial wealth transfer from older to younger generations coincides with the latter's expectations for digital-first services. (…) prioritizing technological strategies such as implementing end-to-end platforms to drive hyper-personalized client experiences and driving extreme automation is essential

Carl Robertson, Chief Marketing Officer, FNZ.

The data used in the article above is taken from FNZ’s forward looking study: Building a Future-Ready Investment Firm. Download now to find out more about how investment providers are embracing new innovative technologies to thrive in the next era of investing as investor demographics and expectations shift worldwide.