M&A indicates an industry in flux

Not a day seems to pass without another Mergers and Acquisitions (M&A) deal being announced in the global wealth management business. Such activity indicates the profound industry realignment occurring as a result of everchanging flux. The last two years has seen a crescendo of such activity. Despite economic head winds, with $200 billion of M&A in the first half of 2022 financial services and significantly $6.7 billion Private Equity (PE) activity in wealth management alone, the M&A boom of 2021 appears to be continuing (Pitchbook, 2022). Trying to make sense of it is bewildering, but some common threads can be drawn.

Asset managers are going direct-to-client (D2C)

A significant amount of M&A activity has been in the insurance and asset management sector — particularly in private wealth divisions. Notably, by acquisition and organic growth, many large-scale asset managers are going direct to clients (the so-called D2C plays). The likes of Vanguard, ABRDN, Aviva and AXA all come to mind, with their D2C fund wrapper platform plays.

Wealth managers and advisors are amalgamating and scaling-up

Meanwhile the fight for the end-client relationship continues with advisors, brokers, and holistic wealth managers vying for position as they scale-up their advisory businesses. Raymond James’ acquisition of the UK’s Charles Stanley demonstrates the fight for scale in client service is very much in vogue. Private equity firms have been particularly active in the intermediary sector; attracted by recuring fees and the ability to scale operations fast, more than 80 PE deals have taken place in the last 12 months alone (Pitchbook, 2022).

What is driving this realignment of the industry?

The acquisitions and mergers of advisory firms are not constrained to a few isolated cases, but part of a clear demographic pattern as boomer-generation wealth firm owners come to retirement. This trend is in full swing in US and will likely gain momentum throughout Europe and APAC over the coming years. Accenture estimates 100,000 wealth managers will come to retirement in Europe alone in the next years, many of which are without clear succession plans for businesses built up over their lifetimes (Accenture, 2022). The collections of advisory businesses variously called Independent Financial Advisors (IFAs), External Asset Managers (EAMs) or Registered Investment Advisors (RIAs) in various jurisdictions will undoubtably see amalgamation.

Notwithstanding the demographics, regulation and technology are also playing their part in the desire for scale. The fact that advice can be delivered by, or in complement with, simple-to-use apps is another reason why firm owners and PE are seeing the opportunity to bring efficiency and scale to the intermediatory and D2C asset management space; investors have become both digitally and financially literate. Regulations, while making life more complex for firm owners, are bringing transparency and standardization to the industry, laying bear the cost of services to investors and making comparison and access to a wide range of investment options simpler and safer.

Perhaps the biggest underlying driver, however, is that wealth management is no longer a niche sector; the mass affluent is a huge and important customer segment with a wide variety of needs. This group has an increasing desire to participate in the investment opportunities that were erstwhile the reserve of the wealthy. BCG estimates the investable financial wealth of this sector to be in excess of $59 trillion alone (BCG, 2022).

In short, the economics of the industry is going through a dramatic step-change – and this is where it gets difficult for many incumbent players.

As a result, asset service and administrative fees are coming under enormous pressure

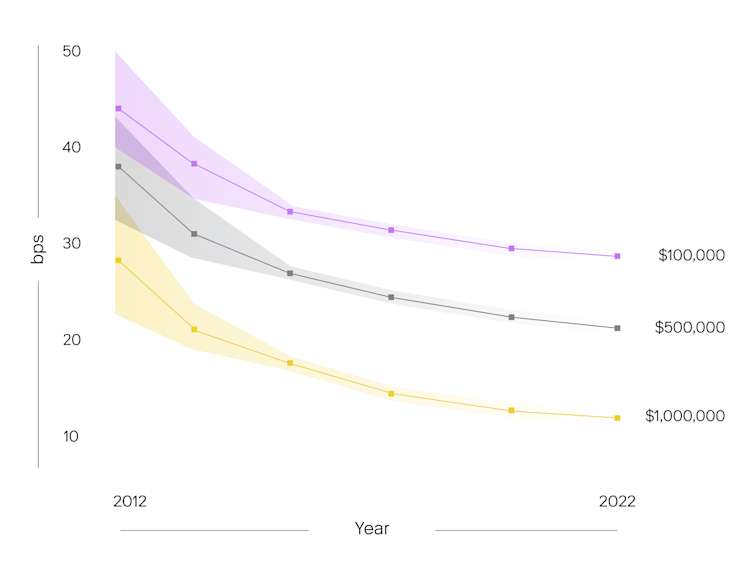

When comparing fees over time across the supply chain of wealth management, it is evident that the back-end processes of asset processing and custody are being hit very hard. Costs are under enormous pressure. FNZ’s own data shows, by way of example, that fees charged for private wealth asset custody services in the UK have dropped by at least 10bps across the board over the last decade, and in many cases by more than 20bps. Notable in this data is the impact of the UK’s Retail Distribution Review (RDR) regulation, bringing fee transparency and consistency to charging models from 2014 onwards. The same observation is not so clear for advisory and asset management fees, which have remained flatter throughout the period – in short, there is more value at the client end of the value chain.

Asset custody and service fees charged to investors in the UK (Source: FNZ)

Trying to do everything is just not sustainable

Clearly if fees are under pressure, then margins inevitably are as well – and therefore firms will find it increasingly difficult to invest, grow and maneuver into new markets and segments. Further, trying to play in asset servicing, client advice, and asset management at the same time is trying to manage conflicting economics. Asset servicing and custody in today’s world requires a scale far beyond that of most wealth managers to be able to reach a reasonable margin. It brings into question the whole idea of managing a full vertically integrated wealth management operation in-house.

The full-service, end-to-end platform model frees wealth managers to focus on client business

This is one reason that many wealth management players are utilizing the dedicated wealth management platform of FNZ. It provides a full end-to-end platform, combining both wealth management technology with asset servicing operations in one unique asset under administration (AUA)-based offering – at massive scale. FNZ services over $1.5 trillion of wealth assets, so can deliver scale economics across the spectrum from small to large wealth management firms. Wealth managers ultimately benefit from automated servicing and custody of assets without the back-end cost pressure - as well as cutting-edge wealth advisory and management technology.

By adopting such an approach, wealth managers have been able to double-down and focus on client experience, advice, and discretionary asset management. They have been able to scale-up their business rapidly and enter new segments and geographic markets without the friction of having to onboard operations staff or new technology.

References:

Accenture, 2022; https://www.accenture.com/us-en/insights/capital-markets/wealth-management-firm-tomorrow-europe

BCG, 2022; https://www.bcg.com/publications/2022/standing-still-not-an-option

Pitchbook, 2022; https://pitchbook.com/news/reports/q2-2022-global-ma-report; https://pitchbook.com/news/articles/private-equity-wealth-management-consolidation