Much is written about the meteoric rise of model portfolios and their use of low-cost passive ETFs as investments in the asset management press. With Blackrock’s Salim Ramji seeing $10tn of assets being managed via model portfolios within 5 years – and Larry Fink’s statement that the global market for ETFs could reach in $15tn in concert with this phenomenon – coverage is reaching a crescendo¹.

The driver is clear, with a potential $60tn of mass affluent investable wealth up for grabs globally, traditional approaches to managing custom investment portfolios cannot keep up with the demand on such a grand scale - at a cost that would be attractive².

Indeed, high costs are why many banks and wealth managers have struggled to serve such a segment profitably. In one recent survey, a third of banks and wealth managers in Europe and Asia expressed no concrete plans to serve the affluent market segment, citing lack of clarity over profitability³. For many wealth managers and banks the changing dynamics of these investment approaches and how to participate are still to be understood and worked through.

So, what needs to happen to make it easier for the wealth managers and advisors to provide personalized investments to more clients - can technology help?

Personalized investments can mean many things

It is perhaps too easy to view scalable investment approaches as simply a way of providing a standard set of models to a retail audience. But in practice there are a wide range of approaches. Through a ‘levels of personalization’ lens, we see several broad approaches emerging across the clients that we serve globally (Figure 1). This starts with the simple model portfolio and low-cost ETFs, which are frequently seen in the D2C asset management offerings and typically have a range of themes or easy to identify risk categories from high to low. Once the investor’s risk tolerance is understood, a standard model portfolio of ETF’s is selected. At the other extreme is the use of institutional techniques to continuously optimize portfolios, with bottom-up construction, geared to direct investments, alternatives and private capital - largely the preserve of high- and ultra-high-net-worth investors. In between we have placed model adaptions and direct indexing. Taking a model and adapting it is becoming a de-facto method for advised clients, whereby the adviser uses the model as a target, makes some tweaks, then constructs a personalized portfolio of ETFs and Mutual Funds.

Figure 1: Levels of personalization

In practice, there are of course many nuances and perspectives on these approaches. For example, one Chief Investment Officer (CIO) explained to us that standardized model portfolios not only make economic sense, but they also help maintain water-tight processes in line with investor protection regulations. By locking down the investment process, client facing relationship managers are restricted from making any adjustment: their focus is on helping the client assess their risk appetite and choosing the appropriate model only.

Meanwhile a director at a private bank convinced us that model portfolio strategies worked well for his high-net-worth discretionary managed client portfolios – with a few adaptions. He viewed the benefits of actively managed custom portfolios in terms of performance with a heavy dose of cynicism and saw the use of advanced institutional grade portfolio risk technology as a costly over-kill.

Direct Indexing is the fastest growing category of personalized investing for the affluent

The fastest growth category, direct indexing, is born out of the need to provide more granular personalization, with direct securities investments, while keeping active management costs under check. This half-way-house starts with a regular index, but then allows the advisors to add, remove, or tilt the portfolio – making use of asset management technology to construct, optimize and rebalance. Investors can ensure their ESG values and individual preferences are embedded in their own highly personal portfolio. And, in jurisdictions that levy capital gains tax on asset disposals, the use of technology to cope with complexities of tax-loss harvesting, fund transitioning, and other optimization techniques is gaining traction. Indeed, the technology costs are making this a popular option for many. From close to zero five years ago, now more than $400bn is estimated to be under management⁴. Its growth rate is expected to outstrip ETFs and Mutual Funds. Nevertheless, despite the use of low-cost technology, direct indexing is still geared towards the higher end of affluence. To replicate a base index, even if kept simple, can require several hundred thousand just to get started - notwithstanding the availability of fractional shares and low-cost execution options.

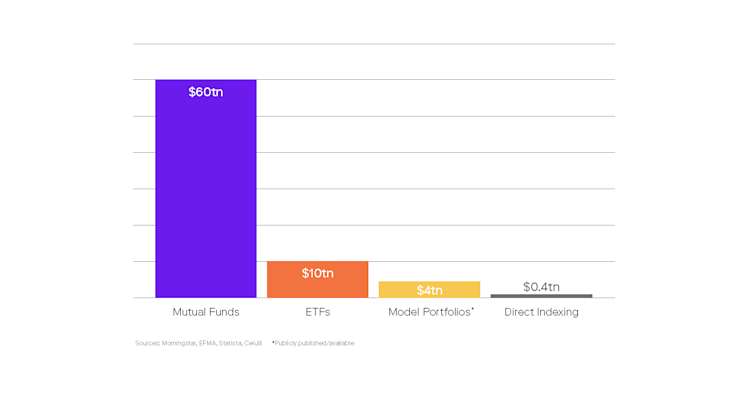

Figure 2: Relative market size for asset manager driven investment solutions⁵⁻⁸

AI techniques bring a powerful dimension to personalization

These highly automated methods lend themselves to the advances in AI. Index tech providers have demonstrated how they use AI-driven factors to make custom adjustments to indexes. For example, the use of natural language processing (NLP) and generative AI methods to assess unstructured research data from multiple sources. Information on company strategy, product developments and ESG factors are often embedded in prospectus’, presentations, and news items. A virtual research assistant quantifies topics into a set of risk factors, enabling the investor to fine-tune the portfolio to their preferences and values⁹.

The landscape is becoming more complex

As with all innovative trends the landscape can look somewhat chaotic.

Model portfolios are created by advisors, dedicated wealth management firms, banks and asset managers alike. Morningstar shows around 3,000 published models in their database. Most are from asset managers, many from large independent advisors - but these are the tip of the iceberg. Inhouse, central CIO created models, are often restricted for use to tied or inhouse advisors, and not published externally. Cerulli, when looking at the advisor market in the US, sees approximately 54% to some extent using externally created asset allocation models and 46% using inhouse strategic allocation methods⁵.

With so much proliferation, and the need to get efficient, the inevitable questions are being asked about which models or indexes are performing well, where do costs lie, who gets the bulk of the fees - and were investors sold the right model for their risk appetite in the first place?

Bringing some order and clarity is needed to ensure wealth managers can find the profitable route to serving the affluent wealth segment and investors get a good deal.

The problem is it doesn’t all connect together as easily as it does with traditional fund distribution. When it comes to model portfolios and direct indexing distribution, the industry remains stranded in a primeval soup.

Figure 3: Lack of connectivity and transparency in model distribution is creating inefficiencies

Making it simple

The next generation of model exchanges and marketplaces need to work across the industry divides and bring greater transparency and efficiency to wealth managers:

The flow of strategy models between asset manager, distributor, and advisor needs to become seamless.

Data needs to flow end-to-end: see-through-analytics must enable asset managers and CIOs to understand the adoption levels and target audience for their designed strategies.

Advanced technical capabilities that adjust, tilt, flex and apply tactical overlays, need to be accessible to advisor and distribution firms, so that they are fully empowered – and in control – of their client’s investments.

Figure 4: Simplifying the personalized investment landscape

An end-to-end platform approach to transformation, that takes care of the connectivity between industry participants is critical for maneuvering the industry shift to personalized wealth solutions. Asset management capabilities, that previously sat in one domain only, will increasingly become distributed and shared along the investors’ value chain as AI and advances in tech are bought to bear. Investors should ultimately benefit from more affordable, impactful and transparent wealth solutions – designed specifically for them.

References

Bloomberg, 2023, https://www.bloomberg.com/news/articles/2023-07-10/blackrock-sees-model-portfolios-growing-to-10-trillion-by-2028

BCG, 2021, https://www.bcg.com/publications/2021/global-wealth-report-2021-delivering-on-client-needs

Capgemeni, 2023, World Wealth Report 2023, https://www.capgemini.com/insights/research-library/world-wealth-report

Cerulli, 2022, The case for direct indexing, https://www.cerulli.com/resource/white-paper-the-case-for-direct-indexing

Cerulli, 2023, U.S. Asset Allocation Model Portfolios 2022, https://www.cerulli.com/reports/us-asset-allocation-model-portfolios-2022

Morningstar, 2022, https://www.morningstar.com/lp/model-portfolio-landscape

EFMA, 2021, https://www.efama.org/sites/default/files/International%20Statistical%20Release%20Q4%202022.pdf

Statistica, 2023, https://www.statista.com/statistics/949668/net-assets-regulated-open-end-funds-worldwide

AllIndex, 2023, AI supported investing, https://allindex.com/recording6

The information contained within this publication is not intended as and shall not be understood or construed as financial advice. The information provided is intended for educational purposes only and you should not construe any such information or other material as legal, tax, investment, regulatory, financial or other advice. Nothing in this publication constitutes investment advice, performance data or any recommendation that any security, portfolio of securities, investment product, transaction or investment strategy is suitable for any specific person. FNZ Group and any its affiliates are not financial advisors and strongly advise you to seek the services of qualified, competent professionals prior to engaging in any investment.

All opinions expressed by the author within this publication are solely the author’s opinion and do not reflect the opinions of FNZ Group, their parent company or its affiliates. You should not treat any opinion expressed by the author as specific inducement to make any specific investment or follow an investment strategy.