Demand for sustainable investing is becoming undeniable. Despite doom-and-gloom commentary early in the challenging 2022 business cycle - including headline-grabbing concerns about greenwashing - third quarter results showed continued flows into sustainable investing focused funds, while the broader market suffered significant outflows.

In the third quarter alone, sustainable-focused funds saw USD $22.6 billion enter the global category, while the broader market experienced outflows of USD -$198 billion. This staggering difference, along with overall investing trends, should make the industry take notice. Most of the demand remains in Europe and the United Kingdom, supported by a strong regulatory agenda and the European Union's Sustainable Financial Disclosure Regulation (SFDR) in particular. However, positive inflows into sustainable-focused funds also occurred in the United States, Canada, Australia and New Zealand.¹

FNZ global data highlights²

We release FNZ’s exclusive global data periodically to highlight important industry trends. By the end of 2022, we saw USD $15.9 billion of ESG-specific funds held in assets under administration (AUA) across all customer platforms. Our data also shows steady increases globally over the last two years in the percent of assets directed toward sustainable or ESG focused funds.

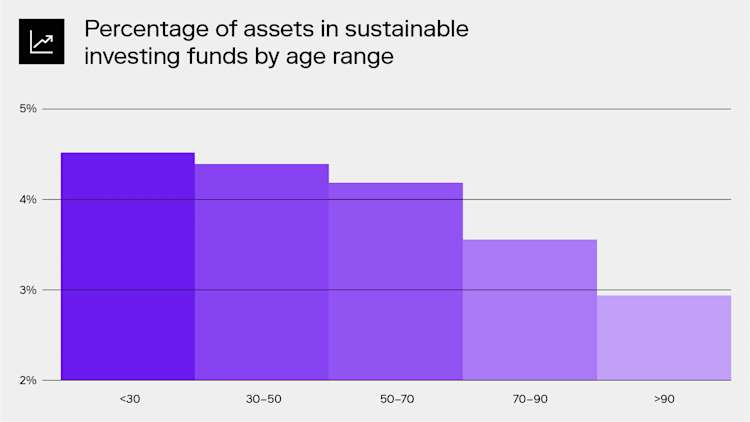

FNZ's analysis of platform data also supports generally held beliefs that younger generations are more likely to invest in sustainable funds; note the rise in the percentage of assets allocated to such with each generation.

The ongoing intergenerational wealth transfer is likely to increase assets focused on sustainable investing over time as younger generations inherit.

Ongoing debate about measurement

This momentum exists despite ongoing issues in sustainable investing. A lack of consistency or regulatory definition persists* (e.g., with terminology such as values-based, responsible, ESG, or sustainable investing), there is conflict in the US around the definition of fiduciary responsibility related to this topic (addressed later in this blog), and concerns with data transparency and measurement remain.

Sustainable-focused investments require the ability to measure more than just financial performance, with data accuracy and transparency paramount

The topic of data in this category is especially interesting. It is critical to know not just which companies and types of equities are associated with a fund, and how those are performing financially, but also to see their quantifiable impact on a sustainability target. Adding to that complexity are economic externalities, meaning effects of goods and services which are not reflected in the price of those goods or services.

The business and economic worlds have always recognized the fact of such effects conceptually, but much of the time they are ignored. However, with values-based investing, quantifying the monetary consequences of environmental externalities becomes increasingly important. Additionally, there is a compelling argument that climate risk adds direct financial risk to many industries as well. Research puts systemic risk from loss of natural resources at an astounding 50% - 55% of global GDP³.

FNZ's Head of Sustainability, Dr. Vian Sharif, contributed to a GIST Impact whitepaper on why an approach called Impact Economics can help create consistency in sustainability measurement. Read in detail about this in Recasting ESG – Separating Drivers from Impacts.

Increasing need for efficient personalization

It is impossible to ignore the relationship between sustainable investing demand and the overall trend in investor perceptions of value. The value our industry delivers to end investors has shifted; investors desire help meeting broader goals instead of investment selection, thus the emergence of goal-based financial planning. Our industry must integrate the relationship of monetary factors with non-financial goals; after all, what is money without humans using it for something? In this context, using investment decisions to support an investor’s values becomes a natural extension of goals-based financial planning.

Using investment decisions to support an investor's values becomes a natural extension of goals-based financial planning. One that is complex.

A natural extension that is also complex. What are the impacts on the firms that directly help investors, or support advisors in doing so? This shift requires providing more personalization to more people, at the same time the industry is losing more advisors than it is gaining. Thus, the ubiquitous need for scale and efficiency in providing, delivering and monitoring financial advice.

There simply is no good one-size-fits-all approach to sustainable investing demand. The Italian Consab Commissioner, Chiara Mosca recently provided an example based on the Italian investor population. She pointed to research showing 63% of Italian investors with interest in sustainable investing, while only 11% actually hold sustainable investments, with that number rising to 17% for those with professional assistance⁴. She noted several areas driving the difference in interest versus action: lack of knowledge, differences in desired level of ESG data for decision making, and variations in need to understand risk/return profiles of investment alternatives. Such variation can only be met with personalization, and meeting that across a broad population requires scale.

Scale in monitoring and tracking are particularly important in the current United States climate, which is in conflict about whether non-pecuniary factors should be taken into account by financial fiduciaries. The governments of conservative states are challenging the appropriateness of using ESG factors in making investment decisions, pushing legislation to emphasize financial returns over other considerations.

At the firm level, in August 2022, 19 Republican state Attorneys General released a letter suggesting it should be considered anti-trust activity when financial institutions coordinate to hit net-zero targets. On the other side of the coin, the Securities and Exchange Commission proposed rule changes that would require registrants to include climate-related disclosures in their statements and reports. And recently the Department of Labor announced a new rule permitting retirement plan fiduciaries to consider climate change and other environmental, social and governance factors when selecting investments and exercising shareholder rights. In this US environment of conflict, it seems wise to document all investment recommendations that may include non-financial factors.

A path forward

What can industry leaders do in the face of these complexities? How to personalize financial advice, incorporate end investor values to meet increasing demand, record the rationale for the advice, deliver transparent sustainability data, and report and rebalance based on both financial and sustainability goals along the way? All at scale.

Companies are faced with a classic build, buy or partner scenario. Most are unlikely to have the expertise, data, or desire to invest in building a solution. It is possible to buy specialty software that works alongside the primary platform, yet that comes with integration challenges. The partner scenario is what FNZ believes will be most fruitful. This is why our purpose is to open up wealth – together. We have integrated FNZ Impact, our award-winning sustainable investing solution, into our global, front-to-back wealth management platform. Currently, FNZ Impact is only available on the FNZ platform. If you are interested in partnering with FNZ to capture the demand for sustainable investing, please get in touch for more information.

*There is new regulation proposed in the United Kingdom to create rules around the use of sustainability terminology by funds, and to address unproductive ‘greenwashing’ labelling. It would standardize the definitions of existing terms and potentially introduce more terminology.

References:

1. Morningstar, 2022 - Global Sustainable Fund Flows Report.

2. FNZ global platform data analysis covered 2020 - 2022. ESG-focused funds were identified by on-platform labels using terminology such as ESG, sustainable, eco, social, green, etc. For the full list, contact FNZ.

3. World Economic Forum, 2020 - Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy and Swiss Re, 2020 - A fifth of countries worldwide at risk from ecosystem collapse as biodiversity declines.

4. CONSOB, February 2023 - VIII Rapporto sulle scelte di investimento delle famiglie italiane.

The information contained within this publication is not intended as and shall not be understood or construed as financial advice. The information provided is intended for educational purposes only and you should not construe any such information or other material as legal, tax, investment, regulatory, financial or other advice. Nothing in this publication constitutes investment advice, performance data or any recommendation that any security, portfolio of securities, investment product, transaction or investment strategy is suitable for any specific person. FNZ Group and FNZ Trust Company are not financial advisors and strongly advises you to seek the services of qualified, competent professionals prior to engaging in any investment.

All opinions expressed by the author within this publication are solely the author’s opinion and do not reflect the opinions of FNZ Group or FNZ Trust Company or their parent company or affiliates. You should not treat any opinion expressed by the author as specific inducement to make any specific investment or follow an investment strategy.